Brunei–Singapore Currency Interchangeability Agreement: 40 Years of Monetary Trust, Stability, and Regional Integration

Introduction: A Commemorative Banknote That Transcends Face Value

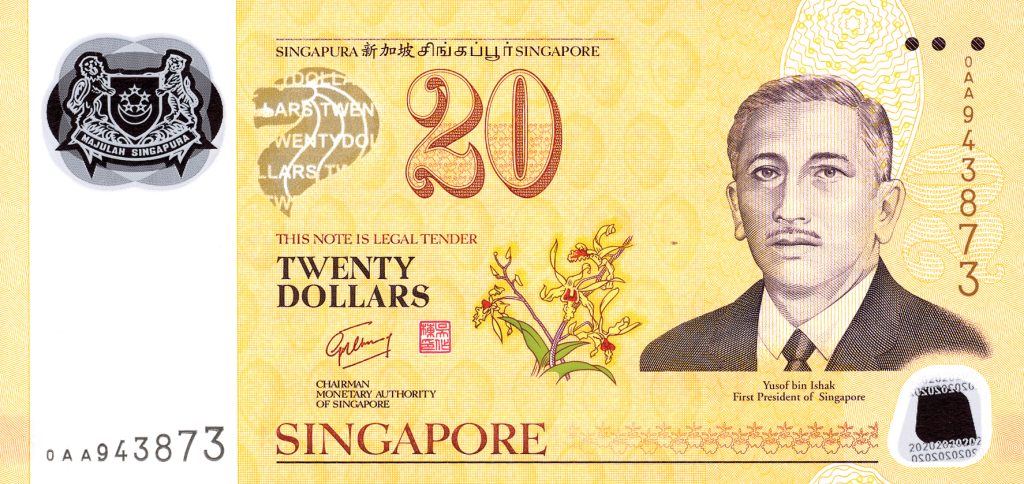

The commemorative 20-ringgit banknote of Brunei Darussalam and the 20-dollar banknote of Singapore, issued to mark the 40th anniversary of the Currency Interchangeability Agreement (CIA) between the two nations, are far more than collector items or symbolic gestures. They represent a tangible manifestation of one of the most unique, durable, and trust-based bilateral monetary arrangements in the modern world.

At a time when many currency pegs have collapsed, monetary unions have fractured, and financial systems have been shaken by repeated global crises, the Brunei–Singapore Currency Interchangeability Agreement has endured—quietly, consistently, and successfully—for four decades. It stands today as a rare case study in monetary cooperation built on mutual trust, institutional discipline, and respect for sovereignty, rather than coercion or political integration.

1. Historical Background: From Colonial Currency to Independent Monetary Paths

1.1 A Shared Monetary Heritage in British Malaya and Borneo

Before the 1960s, the territories of Malaya, Singapore, Sarawak, Sabah, and Brunei shared a common monetary system: the Malaya and British Borneo dollar, issued by the Board of Commissioners of Currency, Malaya and British Borneo. This unified currency facilitated trade, administration, and economic integration across the region during the British colonial period.

However, the wave of decolonization in Southeast Asia fundamentally reshaped the political and economic landscape. Singapore became an independent republic in 1965 after separating from Malaysia, while Brunei pursued a distinct path, maintaining its monarchy and achieving full independence in 1984.

1.2 The Monetary Challenge of Independence

With independence came a critical dilemma for both countries:

-

How could they establish monetary sovereignty without destabilizing their economies?

-

How could they preserve public and international confidence despite relatively small populations and domestic markets?

Singapore adopted a highly disciplined and technocratic approach to monetary management, laying the groundwork for its rise as a global financial hub. Brunei, endowed with substantial oil and gas revenues, prioritized currency stability, purchasing power preservation, and fiscal prudence.

Both nations shared a common philosophy: stability mattered more than experimentation. This convergence of values would soon give rise to an extraordinary monetary arrangement.

2. The Birth of the Currency Interchangeability Agreement

2.1 The 1967 Agreement: A Strategic Innovation

In 1967, Singapore and Brunei signed the Currency Interchangeability Agreement, an unprecedented bilateral accord. Under this agreement:

-

The Singapore dollar (SGD) and the Brunei dollar (BND) are accepted at parity (1:1) in both countries.

-

Each country issues and manages its own currency independently.

-

Both governments guarantee full interchangeability without exchange fees or restrictions.

Crucially, this was not a currency union, nor a conventional exchange-rate peg. There was no supranational monetary authority, no shared central bank, and no loss of policy autonomy. Instead, the agreement relied entirely on institutional credibility and fiscal discipline.

2.2 Institutions Behind the Agreement

-

On Singapore’s side: the Monetary Authority of Singapore (MAS)

-

On Brunei’s side: Autoriti Monetari Brunei Darussalam (AMBD)

Both institutions committed to fully backing their currency issuance with strong reserves, ensuring that neither side could export inflation or instability to the other.

3. Why the CIA Is Exceptionally Rare

3.1 Neither a Monetary Union nor a Currency Peg

Unlike the Eurozone, which uses a single shared currency and centralized monetary policy, or traditional currency pegs that tie one currency to another dominant currency, the CIA is a hybrid model:

-

Two legally distinct currencies,

-

Equal in value,

-

Mutually accepted without restriction.

This structure is viable only when both parties maintain exceptionally low inflation, robust foreign reserves, and unwavering policy credibility.

3.2 Small States, Extraordinary Trust

Both Brunei and Singapore are small states—but with outsized credibility:

-

Singapore is one of the world’s most respected financial centers.

-

Brunei is fiscally conservative, resource-rich, and virtually debt-free.

Their shared commitment to sound money over political opportunism has made the CIA sustainable for decades.

4. Four Decades of Stress Tests

4.1 The Asian Financial Crisis (1997–1998)

While many Southeast Asian currencies collapsed—including the Thai baht, Indonesian rupiah, and Malaysian ringgit—the SGD–BND parity remained intact. The CIA proved resilient even under extreme regional financial stress.

4.2 The Global Financial Crisis (2008)

Despite widespread banking failures and global liquidity shocks, the agreement continued uninterrupted. Both currencies remained fully interchangeable, reinforcing confidence among businesses and citizens alike.

4.3 The COVID-19 Pandemic

Even during border closures, supply-chain disruptions, and unprecedented fiscal interventions, the CIA remained fully operational—highlighting that it was not merely a technical arrangement, but a deep strategic commitment.

5. The 40th Anniversary Commemorative Banknotes

5.1 Symbolic Design and Shared Narrative

The commemorative 20-denomination banknotes issued by both countries feature:

-

The inscription “40 Years” at the center,

-

Iconic Singapore landmarks such as Marina Bay and the Esplanade,

-

Revered Bruneian heritage sites, including the Sultan Omar Ali Saifuddien Mosque.

The design visually expresses two distinct national identities united by a single monetary principle.

5.2 Soft Power and Global Signaling

These banknotes convey a powerful message to the international community:

Trust between sovereign nations can achieve what rigid systems often fail to sustain.

6. The Agreement Today: Relevance in a Digital Age

6.1 Continued Practical Use

As of today:

-

The Singapore dollar circulates freely in Brunei,

-

The Brunei dollar remains legally accepted in Singapore (though less commonly seen).

The parity has never been suspended, renegotiated, or devalued.

6.2 New Challenges: Digital Payments and CBDCs

The rise of cashless transactions and central bank digital currencies (CBDCs) raises new questions about the future of the CIA. However, both governments have made it clear that:

-

The agreement remains fully relevant,

-

It may serve as a foundation for future digital monetary cooperation.

7. Global Significance of the CIA

In a world increasingly characterized by:

-

Financial sanctions,

-

Currency weaponization,

-

Erosion of monetary trust,

the Brunei–Singapore CIA stands as:

-

A peaceful alternative to monetary domination,

-

Proof that cooperation does not require political unification.

Conclusion: Forty Years—and Beyond

The 40th anniversary of the Brunei–Singapore Currency Interchangeability Agreement is not merely a bilateral celebration. It is a reminder that:

-

Monetary stability is a product of trust and discipline,

-

Sovereignty and cooperation can coexist,

-

And sometimes, confidence is more valuable than gold.

The commemorative 20-dollar and 20-ringgit banknotes therefore preserve not only economic value, but also a legacy of financial wisdom—one that continues to offer lessons to the world.